arizona real estate tax rate

The average tax rate on homes in Arizona before exemptions and rebates is typically somewhere between 87 and 15 of market value. Tax Rate 2021 PDF Tax Rate 2020 PDF Tax Rate 2019 PDF Tax Rate 2018 PDF Tax Rate 2017 PDF Tax Rate 2016 PDF Tax Rate 2015 PDF Tax Rate 2014 PDF Tax Rate 2013.

Arizona Property Tax Calculator Smartasset

The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homes.

. For Pima County Property Taxes Realtors can look up the tax history and current tax. The median property tax in Arizona is 135600 per year based on a median home value of 18770000 and a median effective property tax rate of 072. Am I a resident for Arizona state income tax purposes.

Use the physical address or the zip code or if it is unknown the Map Locator link can be used to find the location. 5 things to know about Arizona state income tax Arizona state income tax rates are 259 334 417 and 45. If your home is assessed at 200000 and your property taxes were exactly 13 then youd be paying 2600 per year in property tax.

Purchase of Subsequent Tax Year 500 per CP number 42-18121 Re-assignment 1000 per CP number 42-18122 Duplicate CP 500 42-18120 Administrative Fee Amount Beginning Oct. Snapshot of Recent Federal Capital Gain Tax Rates. For single sellers the first 250000 made from the sale of the home will be exempt from capital gains taxes.

Computing Arizonas Property Tax. These numbers will vary slightly for areas outside of Payson like Christopher Creek or Pine-Strawberry because a portion of property taxes is based on the municipality. The median value of a home in Arizona in 2019 is 193200.

Relationship Between Property Values Taxes Prior to the economic downturn property values were increasing annually reaching a high of 58 billion in assessed value in fiscal year 2009. GOVERNMENT PROPERTY LEASE EXCISE TAX GPLET RATES. AZ Capital Gains 1031 Real Estate Investment and Arizona Capital Gain 1031 Real Estate Investors.

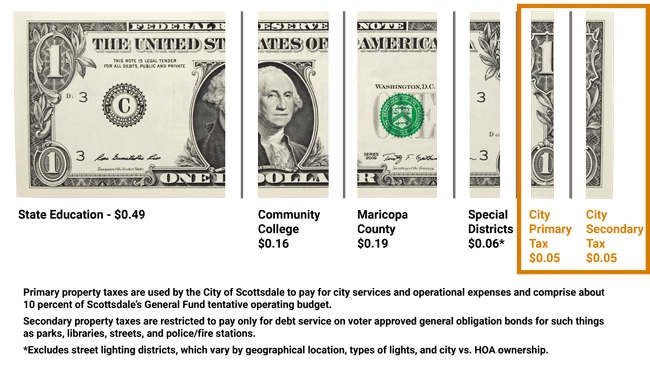

Annually the tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. The FY 2019-20 tax rate and levy were adjusted to fund new public safety and parks and cultural bonds approved by voters in November 2018.

Real Estate Tax Rate. CONTACT INFORMATION Arizona Department of Revenue Local Jurisdictions District Property Tax Unit 1600 West Monroe Street Phoenix AZ 85007-2650 602 716-6843 ptcountyservicesazdorgov. 1st 2017 - Motor Vehicle Division Clearance Letter Copies 500 Relocation Fee charged on Unsecured mobile homes No Fee NSF Insufficient funds payment stopped 2500.

The national average would put the same houses taxes at 1150. Eight or More Story Office Structure. Our Arizona Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Arizona and across the entire United States.

Arizona state offers tax deductions and credits to reduce your tax. Town of Payson 0003594. SD 10 Payson 0003594.

Cities schools water districts community colleges and any assessments will be included in the rate. The average effective tax rate in the state is 062 which is well below the 107 national average. Arizona Property Taxes are based on location.

The state income tax rates range from 259 to 450 and the sales tax rate is 56 and an average local sales tax rate of 28. Two to Seven Story Office Structure. The effective property tax rate in Arizona is 06696.

Arizonas Median Property Tax Is Lower Than Average. Homeowners on average pay a tax rate of 13 of the market value of their home before exemptions and rebates. Capital Gain Tax Rate.

Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Arizona state income tax. Select the appropriate business description and the statecounty and city if applicable transaction privilege.

Your Real Estate Agent will be able to tell you what the current Arizona Property taxes are on a home. The Arizona property tax system is administered jointly by the Arizona Department of Revenue Department and the 15 county assessors and treasurers. The effective real estate tax rate across the state is 072 which means that the annual tax youll owe on a median-priced house comes out to about 1398.

There is however quite a large difference in how much Arizona residents pay in property taxes based on where they stay. For married couples that goes up to 500000. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

Section 1411 Medicare Surtax. That means that if your home is assessed at 100000 your property taxes would be 600. One Story Office Structure.

You can look up your recent appraisal by filling out the form below. The FY 202021 annual secondary property tax levy for the median-value City of Mesa residential property is 160. Here in Arizona if homeowners have lived in their main home for less than two years they will be liable to pay capital gains taxes.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Taxes In Arizona How Are They Assessed And When Are They Paid Homes For Sale Real Estate In Scottsdale Az Az Golf Homes

Arizona Property Tax Calculator Smartasset

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

City Of Scottsdale Truth In Taxation Notice

Property Taxes By State County Lowest Property Taxes In The Us Mapped

States With Highest And Lowest Sales Tax Rates

Arizona Sales Tax Small Business Guide Truic

Property Taxes Property Tax Analysis Tax Foundation

Arizona Property Tax Calculator Smartasset

What I Need To Know About Property Taxes In Arizona

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation